Incident Response for Trusted Advisors: Why Proactive Preparation Is a Business Conversation (Not a Technical One) – Part 2

Why this conversation matters now

In our first post, How to Sell Incident Response: The Trusted Advisor Playbook, we focused on how to start proactive conversations about incident response, using curiosity and business outcomes instead of fear or jargon.

Now that you’ve opened the door, this part is about what comes next: how to lead the discussion once you’re in the room. It’s about helping executives understand that incident response is not just a technical exercise, but a strategic business investment that protects continuity, reputation, and revenue.

Before a breach, every executive sees preparation for incident response differently:

- CEOs often assume they’re not a target, so investment feels optional

- CFOs may assume the internal team can handle it, without outside assistance

- CISOs usually are the ones sounding the alarm, as they see the gaps firsthand

But once a breach happens, everyone realizes it’s not an IT issue—it’s a business disruption.

Your role as a Trusted Advisor is to help clients bridge that gap before it happens. You’re not just selling a service; you’re helping them safeguard uptime, protect their reputation, and maintain customer confidence in the face of disruption. That’s what real cyber resilience looks like.

This guide will help you navigate the conversation so you can have these conversations and be the hero when (not if) something bad happens.

Table of contents

Incident response is a business discussion, not a technical one

Clients often hear “incident response” and picture forensics or software tools. The real impact shows up on the P&L. Lost revenue. Missed SLAs. Customer churn. That is your opening.

Let’s skip the jargon and use questions that leaders actually care about:

- How much would a day of downtime cost your business?

- Who owns the communication to the board and customers?

- Would your cyber insurance pay if this happened tomorrow?

These questions make the conversation about outcomes, not acronyms. And outcomes sell.

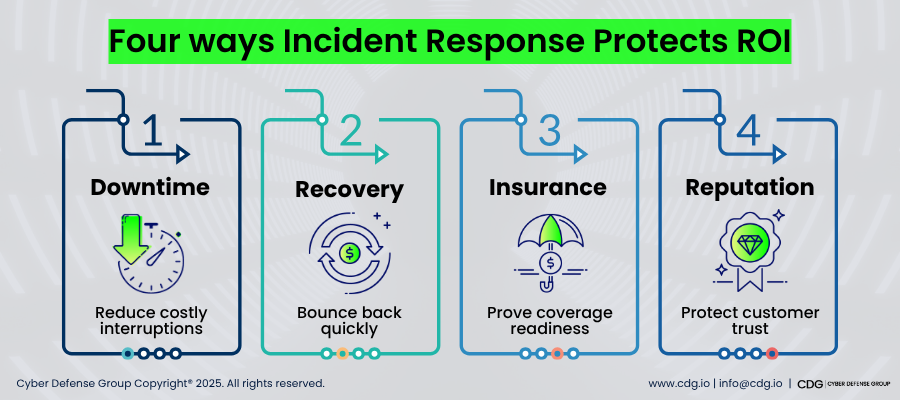

The business value of proactive incident response

Incident response planning isn’t about being paranoid, it’s about protecting continuity and proving ROI. Here’s how to make that value real for business leaders.

Less downtime means fewer lost dollars

A mid‑market SaaS company lost roughly $250,000 in a single day of downtime during a ransomware event. The ransom wasn’t even the largest hit to the bottom line: it was the lost revenue and frustrated customers. A tested plan can cut recovery time in half, turning a crisis into a controlled response. Test plan = measurable ROI.

Faster recovery builds trust

A healthcare provider that ran a tabletop exercise months before a phishing incident, which allowed them to come back online in hours instead of days. Employees stayed calm. Patients saw continuity, not chaos. And the business didn’t take a massive financial hit, with leadership emerging as looking prepared.

Proactive planning helps with insurance and compliance

Many cyber insurers now require documented incident response plans and testing. Prepared clients avoid premium hikes, speed up claims, and demonstrate governance maturity, which can also strengthen their compliance standing with auditors and customers.

Reputation protection preserves growth

Even without public headlines, mid-market brands lose deals when partners realize they weren’t prepared. A documented plan signals credibility and reliability, key factors for growth and partnership retention.

See how Cyber Defense Group helps Trusted Advisors simplify and sell incident response services with confidence.

What happens when there is no plan

“We’ll figure it out if something happens” is an expensive bet. Common failure patterns include:

- No clear decision‑maker or chain of command

- Extended downtime and a slow recovery

- Insurance delays or denials due to missing documentation

- Loss of confidence across customers, employees, and stakeholders

Analyst estimates put average downtime at thousands of dollars per minute. Even a short outage can derail a quarter. Preparation isn’t fear; it’s math.

Reference: IBM Cost of a Data Breach Report

How Trusted Advisors start the right conversation

Skip scare tactics. Use prompts that are specific and practical, or ones in this blog on how to sell incident response services proactively.

- Compliance and insurance: We’re seeing tighter insurer requirements around incident response planning. Have you reviewed yours?

- Peer comparison: Many of your peers run tabletop exercises twice a year. Is that what you’re doing?

- Business impact: If your systems went dark for 72 hours, where would the biggest business hit land?

None of this requires deep technical knowledge. It requires curiosity and a focus on business impact.

Becoming the bridge your clients need

You do not have to be the forensics expert or the crisis negotiator. Your edge is your connection.

- Translate risk into plain business language

- Connect executives, legal, insurance, and technical teams

- Guide action before panic hits and keep calm when it does

Trusted Advisors who master this move beyond selling tools, they build loyalty and become the first call when a crisis hits. Voilà!

Bringing it all together

Incident response for Trusted Advisors is not about the tool stack. It’s about confidence in the boardroom. Frame the discussion around resilience, reputation, and ROI. That’s how you’ll move from just another vendor to a strategic ally.

Partner with Cyber Defense Group to elevate your client conversations about incident response

Related reading

FAQ

What does incident response ROI mean?

It is the value of readiness. Less downtime, faster recovery, and fewer losses when incidents happen.

Do I need to be technical to sell incident response?

No. Focus on outcomes, not jargon. Your job is to help leaders see how preparation protects revenue and trust.

How does Cyber Defense Group support Trusted Advisors?

Cyber Defense Group provides incident response frameworks, tabletop exercises, and materials to help you lead client conversations with confidence and close more opportunities.